- Participants in Indian Money Market

by arizzaman5Participants in the Indian Money Market. The money market is characterized by voluminous transactions involving substantial amounts. The number of money market players is limited, but they are very active and in a dominant position. The following are some of the major market participants: 1) Reserve Bank of India (RBI): The central bank of the … Read more

by arizzaman5Participants in the Indian Money Market. The money market is characterized by voluminous transactions involving substantial amounts. The number of money market players is limited, but they are very active and in a dominant position. The following are some of the major market participants: 1) Reserve Bank of India (RBI): The central bank of the … Read more - Functions of Financial System.

by arizzaman5Functions of Financial System. For the economic transformation of a country, the financial system is the key to the institutional and functional vehicle. Finance assists in reducing the gap between the present and the future, and covers every aspect like channelization and effective usage of savings and making an efficient investment. It formulates the base, … Read more

by arizzaman5Functions of Financial System. For the economic transformation of a country, the financial system is the key to the institutional and functional vehicle. Finance assists in reducing the gap between the present and the future, and covers every aspect like channelization and effective usage of savings and making an efficient investment. It formulates the base, … Read more - Importance of Financial System

by arizzaman5Importance of Financial System. For the economic transformation of a country, the financial system is the key to the institutional and functional vehicle. Finance assists in reducing the gap between the present and the future, and covers every aspect like channelization and effective usage of savings and making an efficient investment. It formulates the base, … Read more

by arizzaman5Importance of Financial System. For the economic transformation of a country, the financial system is the key to the institutional and functional vehicle. Finance assists in reducing the gap between the present and the future, and covers every aspect like channelization and effective usage of savings and making an efficient investment. It formulates the base, … Read more - Types of Capital Budgeting

by arizzaman5Types of Capital Budgeting. Capital Budgeting Capital budgeting is the process of deciding how to invest in long-term assets (like land, buildings, machinery, furniture, etc.) that won’t be sold but will bring in money for the business. It involves long-term planning and monitoring of capital expenditure, as well as examining each proposal in a very … Read more

by arizzaman5Types of Capital Budgeting. Capital Budgeting Capital budgeting is the process of deciding how to invest in long-term assets (like land, buildings, machinery, furniture, etc.) that won’t be sold but will bring in money for the business. It involves long-term planning and monitoring of capital expenditure, as well as examining each proposal in a very … Read more - Components of Capital Budgeting

by arizzaman5components of capital budgeting. The exercise of “capital budgeting” analysis involves the following essential components: 1) Cash Outflows: The initial investment in a project, as well as subsequent investments at various stages, must be carefully estimated. Besides the cost of the core assets required for the project, other miscellaneous expenses involved in the project implementation, … Read more

by arizzaman5components of capital budgeting. The exercise of “capital budgeting” analysis involves the following essential components: 1) Cash Outflows: The initial investment in a project, as well as subsequent investments at various stages, must be carefully estimated. Besides the cost of the core assets required for the project, other miscellaneous expenses involved in the project implementation, … Read more - Importance of Capital Budgeting

by arizzaman5The importance of capital budgeting. Capital budgeting for making an investment decision is the most effective and powerful tool. The importance of capital budgeting may be gauged from the following points: 1) Long-Term Effects: Decisions taken through capital budgeting are generally irreversible; they can be reversed, if at all possible, with a lot of difficulties. … Read more

by arizzaman5The importance of capital budgeting. Capital budgeting for making an investment decision is the most effective and powerful tool. The importance of capital budgeting may be gauged from the following points: 1) Long-Term Effects: Decisions taken through capital budgeting are generally irreversible; they can be reversed, if at all possible, with a lot of difficulties. … Read more - Unsystematic Risk- Types of Risk

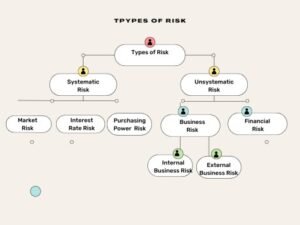

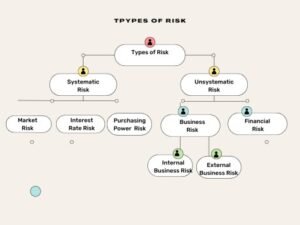

by arizzaman5Unsystematic Risk. also known as “diversifiable risk,” as it can be managed and controlled, unlike “systematic risk.” which is difficult to manage and control as it is widespread and covers the entire system. The unsystematic risk may be specific to an industry or company and is caused by one or more of the following: 1) … Read more

by arizzaman5Unsystematic Risk. also known as “diversifiable risk,” as it can be managed and controlled, unlike “systematic risk.” which is difficult to manage and control as it is widespread and covers the entire system. The unsystematic risk may be specific to an industry or company and is caused by one or more of the following: 1) … Read more - Types of Risk – Systematic Risk

by arizzaman5Systematic Risk. There are a number of risks a business organization is exposed to, like ‘Market Risk’, ‘Interest Rate Risk’, ‘Country Risk’, ‘Business Risk’, ‘Financial Risk’, etc. They can be put under two broad categories: Systematic Risk The risk, which is inherent to the entire market or system, is termed a ‘Systematic Risk’ or ‘Uncontrollable … Read more

by arizzaman5Systematic Risk. There are a number of risks a business organization is exposed to, like ‘Market Risk’, ‘Interest Rate Risk’, ‘Country Risk’, ‘Business Risk’, ‘Financial Risk’, etc. They can be put under two broad categories: Systematic Risk The risk, which is inherent to the entire market or system, is termed a ‘Systematic Risk’ or ‘Uncontrollable … Read more - Modigliani and Miller (MM) Model

by arizzaman5Modigliani and Miller (MM) Model. The genesis of the Dividend Irrelevance Theory of Modigliani and Miller may be traced back to the “Capital Irrelevance Model’ advocated by them in a paper published in 1958. Under the above model, a was held that the capital structure of a company has no relevance as far as its … Read more

by arizzaman5Modigliani and Miller (MM) Model. The genesis of the Dividend Irrelevance Theory of Modigliani and Miller may be traced back to the “Capital Irrelevance Model’ advocated by them in a paper published in 1958. Under the above model, a was held that the capital structure of a company has no relevance as far as its … Read more - Operating & Cash Conversion Cycle

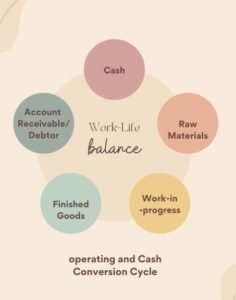

by arizzaman5Operating & Cash Conversion Cycle. The time taken for the completion of the cycle of the processes of conversion of raw material into finished goods, sale of goods, the realization of sale proceeds, and receipt of cash is termed the ‘Operating and Cash Conversion Cycle’ or ‘Working Capital Cycle.” The operating cycle of a company … Read more

by arizzaman5Operating & Cash Conversion Cycle. The time taken for the completion of the cycle of the processes of conversion of raw material into finished goods, sale of goods, the realization of sale proceeds, and receipt of cash is termed the ‘Operating and Cash Conversion Cycle’ or ‘Working Capital Cycle.” The operating cycle of a company … Read more - Determinants of Working Capital

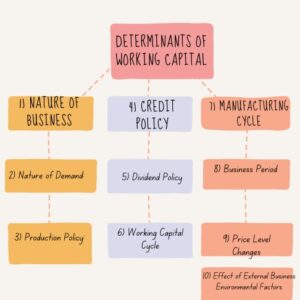

by arizzaman5The level of working capital requirements of a company is determined by the following factors 1) Nature of Business: The nature of a company’s business is the prime determinant of its working capital requirements. Businesses of small size, especially those engaged in trading of goods, need a high level of working capital to fulfill their … Read more

by arizzaman5The level of working capital requirements of a company is determined by the following factors 1) Nature of Business: The nature of a company’s business is the prime determinant of its working capital requirements. Businesses of small size, especially those engaged in trading of goods, need a high level of working capital to fulfill their … Read more - Motives for Holding Cash

by arizzaman5Motives for Holding Cash. One of the most important constituents of current assets is “cash.” It is required to carry out all the activities of the business. A business should have enough cash on hand to pay its bills right now and in the future. Cash, being totally unproductive by nature, should be kept at … Read more

by arizzaman5Motives for Holding Cash. One of the most important constituents of current assets is “cash.” It is required to carry out all the activities of the business. A business should have enough cash on hand to pay its bills right now and in the future. Cash, being totally unproductive by nature, should be kept at … Read more - Factors Affecting the Level of Cash

by arizzaman5Factors Affecting the Level of Cash. There are a number of things that affect how much cash is needed, such as: 1) Credit Position of the Firm: The cash balance depends upon the credit position in the following two ways: i) If a firm’s credit position is strong, only a reasonable amount of cash balances … Read more

by arizzaman5Factors Affecting the Level of Cash. There are a number of things that affect how much cash is needed, such as: 1) Credit Position of the Firm: The cash balance depends upon the credit position in the following two ways: i) If a firm’s credit position is strong, only a reasonable amount of cash balances … Read more - Investing Surplus Cash

by arizzaman5Investing Surplus Cash. Surplus cash that is not required in the short run should be invested in liquid assets, Le.. marketable securities, or other securities that can be instantly converted into cash when required. Cash itself is an unproductive asset, and keeping it in the same form will not benefit the firm. Rather, it has … Read more

by arizzaman5Investing Surplus Cash. Surplus cash that is not required in the short run should be invested in liquid assets, Le.. marketable securities, or other securities that can be instantly converted into cash when required. Cash itself is an unproductive asset, and keeping it in the same form will not benefit the firm. Rather, it has … Read more - Controlling Cash Outflows

by arizzaman5Controlling cash outflows. Just as the basic rule for increasing cash inflows is to increase collection speed, the basic rule for decreasing cash outflows is to slow down the payment process. For this, a centralized payment system may be adopted, just as a decentralized collection system was adopted in the case of receivables. A reasonable … Read more

by arizzaman5Controlling cash outflows. Just as the basic rule for increasing cash inflows is to increase collection speed, the basic rule for decreasing cash outflows is to slow down the payment process. For this, a centralized payment system may be adopted, just as a decentralized collection system was adopted in the case of receivables. A reasonable … Read more - Types of Inventories

by arizzaman5Types of Inventories. Inventory denotes “stock of goods”. Various authors have defined this word in their own way. In terms of accounting, the word may be used to refer to the stock of finished goods only, while in a manufacturing concern this may include work in process, stores, raw materials, etc. The following are the … Read more

by arizzaman5Types of Inventories. Inventory denotes “stock of goods”. Various authors have defined this word in their own way. In terms of accounting, the word may be used to refer to the stock of finished goods only, while in a manufacturing concern this may include work in process, stores, raw materials, etc. The following are the … Read more - Inventory’s meaning and nature.

by arizzaman5Inventory’s meaning and nature. Inventory denotes “stock of goods”. Various authors have defined this word in their own way. In terms of accounting, the word may be used to refer to the stock of finished goods only, while in a manufacturing concern this may include work in process, stores, raw materials, etc. International Accounting Standard … Read more

by arizzaman5Inventory’s meaning and nature. Inventory denotes “stock of goods”. Various authors have defined this word in their own way. In terms of accounting, the word may be used to refer to the stock of finished goods only, while in a manufacturing concern this may include work in process, stores, raw materials, etc. International Accounting Standard … Read more - Inventory Management Techniques

by arizzaman5Inventory Management Techniques There are several inventory control techniques available, and which technique is used is determined by the nature and ease of the organization. An ideal inventory control technique, however, should cover all items and all stages of inventory control, starting from the stage when the material is received from the supplier until it … Read more

by arizzaman5Inventory Management Techniques There are several inventory control techniques available, and which technique is used is determined by the nature and ease of the organization. An ideal inventory control technique, however, should cover all items and all stages of inventory control, starting from the stage when the material is received from the supplier until it … Read more - Types/Classification of Working Capital

by arizzaman5Classification of Working Capital. Working capital may be classified in two ways, viz., on the basis of “concept” or on the basis of “time,” both of which are discussed below: 1) On the Basis of Concept: On a conceptual basis, working capital is classified as ‘Gross Working Capital’ and ‘Net Working Capital. For the department … Read more

by arizzaman5Classification of Working Capital. Working capital may be classified in two ways, viz., on the basis of “concept” or on the basis of “time,” both of which are discussed below: 1) On the Basis of Concept: On a conceptual basis, working capital is classified as ‘Gross Working Capital’ and ‘Net Working Capital. For the department … Read more - Operating Leverage

by arizzaman5Operating leverage is related to the cost structure of a firm. It uses fixed costs incurred by the firm to maximize the returns. A cost is considered fixed when it remains the same even with a change in the output. In short, fixed costs are not affected by the change in production volume. Operating leverage … Read more

by arizzaman5Operating leverage is related to the cost structure of a firm. It uses fixed costs incurred by the firm to maximize the returns. A cost is considered fixed when it remains the same even with a change in the output. In short, fixed costs are not affected by the change in production volume. Operating leverage … Read more - Bank Finance

by arizzaman5Bank borrowing is one of the important sources of finance for companies in the need of funds and working capital requirements. Bank borrowing, as a source of short-term finance, ranks just next to Trade Finance’, which is the most popular mode of short-term finance in India. The amount approved by a bank for a company’s … Read more

by arizzaman5Bank borrowing is one of the important sources of finance for companies in the need of funds and working capital requirements. Bank borrowing, as a source of short-term finance, ranks just next to Trade Finance’, which is the most popular mode of short-term finance in India. The amount approved by a bank for a company’s … Read more - Objectives of Inventory Managementby arizzaman5Objectives of Inventory Management. The following are the main objectives of inventory management: 1) Operational Objectives: These objectives include material and other parts which are available in sufficient quantity: i) Availability of Material: The main objective of inventory management is to ensure that a firm has the availability of various goods, as and when required. … Read more

- Primary Market

by arizzaman5Meaning of Primary Market This denotes the New Issue Market i.e. where the shares are issued for the very first time. In other words, the same was never issued before in the market. Under this, the existing companies and the new entrants can bring new issues. The basic objective is to procure funds from the … Read more

by arizzaman5Meaning of Primary Market This denotes the New Issue Market i.e. where the shares are issued for the very first time. In other words, the same was never issued before in the market. Under this, the existing companies and the new entrants can bring new issues. The basic objective is to procure funds from the … Read more

ONLINE EARNING