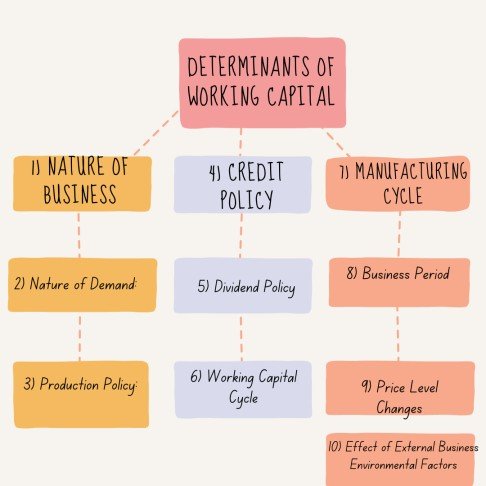

The level of working capital requirements of a company is determined by the following factors

1) Nature of Business:

The nature of a company’s business is the prime determinant of its working capital requirements. Businesses of small size, especially those engaged in trading of goods, need a high level of working capital to fulfill their daily cash requirements. In small businesses initial outlay of fixed capital is small but the working capital requirement is more, whereas, in the case of businesses of large size, the initial outlay of fixed capital is more (for investment in fixed assets) than the working capital requirement.

2) Nature of Demand: ( Determinants of working capital. )

Market demand for the product manufactured by a company influences its working capital requirement. In fact, they (demand for the product and working capital requirement) are inversely proportional. A company, whose products can be sold smoothly, needs a low level of working capital when compared with another company, whose products are less in demand and therefore it is difficult to sell them in the market. The ‘Net Operating Cycle’ of the former company is low, necessitating a low level of working capital requirement, bug whereas the latter company has a high ‘Net OW Operating Cycle’, necessitating a higher level of working capital requirement.

3) Production Policy:

The production Policy’ of a company is another deciding factor with regard to the level of its working capital requirement. Different companies have different ‘Production Policies’. Some companies have a policy to cut- production or stop it altogether during slack/off-season, which results in a reduction in

i) Number of employees,

ii) The level of inventory, viz. raw material, work-in-progress, finished goods, and

iii) Day-to-day expenses.

The working capital requirement also gets reduced in that proportion. However, some companies have a policy to maintain the same level of production even during the slack season also. The working capital requirement of such companies continues to remain the same irrespective of the season, i.e., slack season or peak season.

4) Credit Policy:

The policy of a manufacturing unit with regard to its purchasing and selling of goods on a credit or cash basis is an important factor to determine the level of its working capital requirement. If a company can afford to have a policy of purchasing its raw material on a credit basis and selling its finished goods on a cash or advance basis, its working capital requirement would be at a much lower level. In the case of a reverse scenario, i.e., if a company is compelled to have a policy of purchasing raw materials on a cash basis, and selling its finished goods on a credit basis, its working capital requirement would be at a higher level.

5) Dividend Policy: (Determinants of working capital )

The ‘Dividend Policy’ of a company is capable of influencing its working capital requirement. If a company has a policy of distributing a major portion of the profit as dividends to its shareholders, it needs to be backed by an appropriate level of ‘Reserves’. In the absence of suitable ‘Reserves’, such a policy may affect the level of working capital requirement adversely, i.e., more working capital would be required. In case of uncertain liabilities arising, the company may have to resort to a short-term loan.

6) Working Capital Cycle:

Various steps involved in the “Working Capital Cycle’ are:

i) Cash,

ii) Purchase of raw material, iii) Work-in-progress,

iv) Finished goods,

v) Sale of finished goods, vi) Sundry debtors, and

vii) Cash.

The shorter the ‘Working Capital Cycle’, cash would come back to business fast and the level of WC requirement would be lower. In the reverse scenario, i.e., longer ‘Working Capital Cycle’, cash would come back to the business late and the level of working capital requirement would be higher.

7) Manufacturing Cycle:

The process of conversion of raw material into finished goods is termed go Manufacturing Cycle’. A longer ‘Manufacturing Cycle’ would require a large amount of working capital, whereas a shorter ‘Manufacturing Cycle’ would require less amount of working capital.

8) Business Period:

Two main components of ‘Business are ‘Boom’ and ‘Recession‘. The requirement for working capital is more during the Boom Period’, whereas in the ‘Recession Period’ the requirement for working capital is comparatively less.

9) Price Level Changes: (Determinants of working capital. )

The increasing trend in the cost of raw materials and miscellaneous expenses, etc, would result in a higher amount of capital. Its vice-versa is also true, i.e., if the cost of raw materials and miscellaneous expenses show a decreasing trend, the working capital requirement would be at a lower level.

10) Effect of External Business Environmental Factors:

The factors which are external to the business (and a company not having control over such factors) may affect the level of working capital requirement in a favorable manner or otherwise. Such factors include general economic conditions, global conditions, fiscal policy, monetary policy, regulatory policy instructions, statutory requirements, etc.

Types/Classification of Working Capital – Click here